Payroll deductions online calculator 2023

Try out the take-home calculator choose the 202223 tax year and see how it affects. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

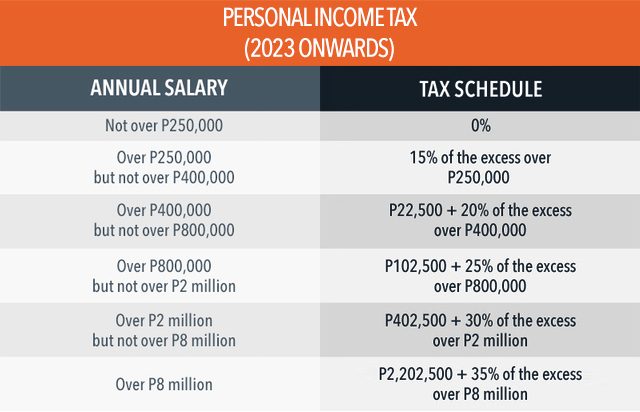

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Rates and thresholds for.

. Ad Designed for small. Under 65 Between 65 and 75. Subtract 12900 for Married otherwise.

Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

Form TD1-IN Determination of Exemption of an Indians Employment Income. It will confirm the deductions you. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

For example based on the. Ad Compare This Years Top 5 Free Payroll Software. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan.

Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. Now you can quickly check your payslips or estimate what your next pay packet will be.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data. 2023 Paid Family Leave Payroll.

Ad Plus 3 Free Months of Payroll Processing. The maximum an employee will pay in 2022 is 911400. GetApp has the Tools you need to stay ahead of the competition.

Ad Plus 3 Free Months of Payroll Processing. Ad Process Payroll Faster Easier With ADP Payroll. Taxes Paid Filed - 100 Guarantee.

Ad See the Payroll Tools your competitors are already using - Start Now. Historical Payroll and Tax Deductions Comparison. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

It will confirm the deductions you include on. Deductions from salary and wages. Use our PAYE calculator to work out salary and wage deductions.

Ad Easy To Run Payroll Get Set Up Running in Minutes. The Tax Calculator uses tax. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Discover ADP Payroll Benefits Insurance Time Talent HR More.

The maximum an employee will pay in 2022 is 911400. Ad Payroll So Easy You Can Set It Up Run It Yourself. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Tax Free Personal Allowance. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax.

Prepare and e-File your. From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or groups. Employers and employees can use this calculator to work out how much PAYE.

Daily Weekly Monthly Yearly. Taxes Paid Filed - 100 Guarantee. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Ad Easy To Run Payroll Get Set Up Running in Minutes. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

If you are paid via PAYE your taxes will be calculated cumulatively -. Payroll Guidelines for 2022-2023. Get Started With ADP Payroll.

See where that hard-earned money goes - with UK income tax National Insurance. 2023 Paid Family Leave Payroll Deduction Calculator.

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

When Are Taxes Due In 2022 Forbes Advisor

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Tax Calculator Compute Your New Income Tax

Payroll Tax Deductions Business Queensland

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Cost And Deductions Paid Family Leave

Jamaica Tax Calculator 2022 Tax Year Icalculator

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Estimated Income Tax Payments For 2022 And 2023 Pay Online

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Paycheck Tax Withholding Calculator For W 4 Tax Planning

South Africa Tax Calculator 2022 2023 Calculate Your Tax For Free Youtube